Your premier ally in shaping the next era of IoT in banking

Gain insights on how to leverage the Internet of Things in the banking industry for better decision-making and operational excellence. Let’s create something remarkable together. Start your journey with us today.

How can you use IoT in banking?

Internet of Things(IoT) devices like sensors and cameras help keep banks secure & monitor their ATMs. Banks also use IoT to track how customers use their services in branches, helping to improve customer experience. Additionally, IoT enables smart ATMs and other devices to send real-time data to banks, so they can manage cash flow and maintenance needs efficiently.

Explained with 4 examples

Example 1: ATMs

Automated teller machines (ATMs) can send information about their status or any faults to the bank. They can also tell when they’re running low on cash.

Example 2: personalized marketing

Banks can use data from IoT devices to understand customers’ spending habits. They might offer discounts or special deals when clients are near shops or businesses they partner with.

Example 3: asset management

IoT helps banks keep track of their physical assets like computers, furniture, and even cash transit vehicles in real-time, making sure everything is where it’s supposed to be.

Example 4: smart branches

Banks are creating “smart branches” with IoT devices that can tell them how many people visit and at what times, so they can manage staff better and improve customer service.

How IoT is changing banking: latest trends

See insights on how to leverage IoT in banking

Trend: biometric ATMs

ATMs equipped with IoT can now use biometric verification, like fingerprint or facial recognition, to enhance security and reduce fraud.

Trend: connected cars

Banking services are expanding into IoT-enabled vehicles, where you could pay for gas, tolls, or parking directly from your car’s dashboard.

Trend: smart contracts

With IoT, banks are starting to use blockchain-based smart contracts that self-execute and self-maintain, based on real-time asset and data tracking, making transactions more secure and efficient.

We at SumatoSoft develop custom IoT solutions for the banking industry.

Get in touch to find out how we can help you.

What advantages can you get from IoT in banking?

Discover the advantages of SumatoSoft custom IoT solutions

You will get improved customer experience:

The Internet of Things can provide personalized banking services. For example, smart ATMs can offer a faster and more tailored service based on the customer’s transaction history.

You will get better risk management:

IoT devices can gather real-time data that banks can use to assess credit risk or detect fraud quickly.

You will get cost savings:

Automating routine tasks and improving asset tracking with IoT can reduce operational costs.

You will get enhanced security:

Internet of Things devices can help monitor and detect suspicious behavior around ATMs and branches in real-time, potentially reducing fraud and theft.

You will get operational efficiency:

You can use IoT data to better manage resources, like optimizing ATM cash levels based on usage patterns, saving on restocking costs and reducing downtime.

You will get data-driven decision making:

IoT devices can collect vast amounts of data, which, when analyzed, can provide insights into customer behavior and preferences.

Technologies we work with

Frequently asked questions

What is the Internet of Things in the context of banking?

IoT in banking refers to the use of interconnected devices and sensors that collect and exchange data to improve banking services, enhance security, and offer personalized customer experiences.

How is SumatoSoft contributing to IoT in the banking industry?

SumatoSoft is at the forefront of IoT by developing secure, innovative solutions that improve operational efficiency, enhance customer experiences, and offer new banking services through the power of IoT technology.

What is the process SumatoSoft follows to develop a custom IoT solution for a bank?

Our process begins with an in-depth analysis of the bank’s requirements, followed by designing a prototype. After rigorous testing and client feedback, we move on to development and integration.

How does SumatoSoft support banks after deploying an IoT solution?

Post-deployment, SumatoSoft provides comprehensive support including system updates, maintenance, and 24/7 troubleshooting to ensure continuous, smooth operations of the IoT banking solutions we provide.

How does IoT reduce costs for banks?

IoT reduces costs by automating services, minimizing equipment failures through predictive maintenance, and optimizing resource management, resulting in operational cost savings.

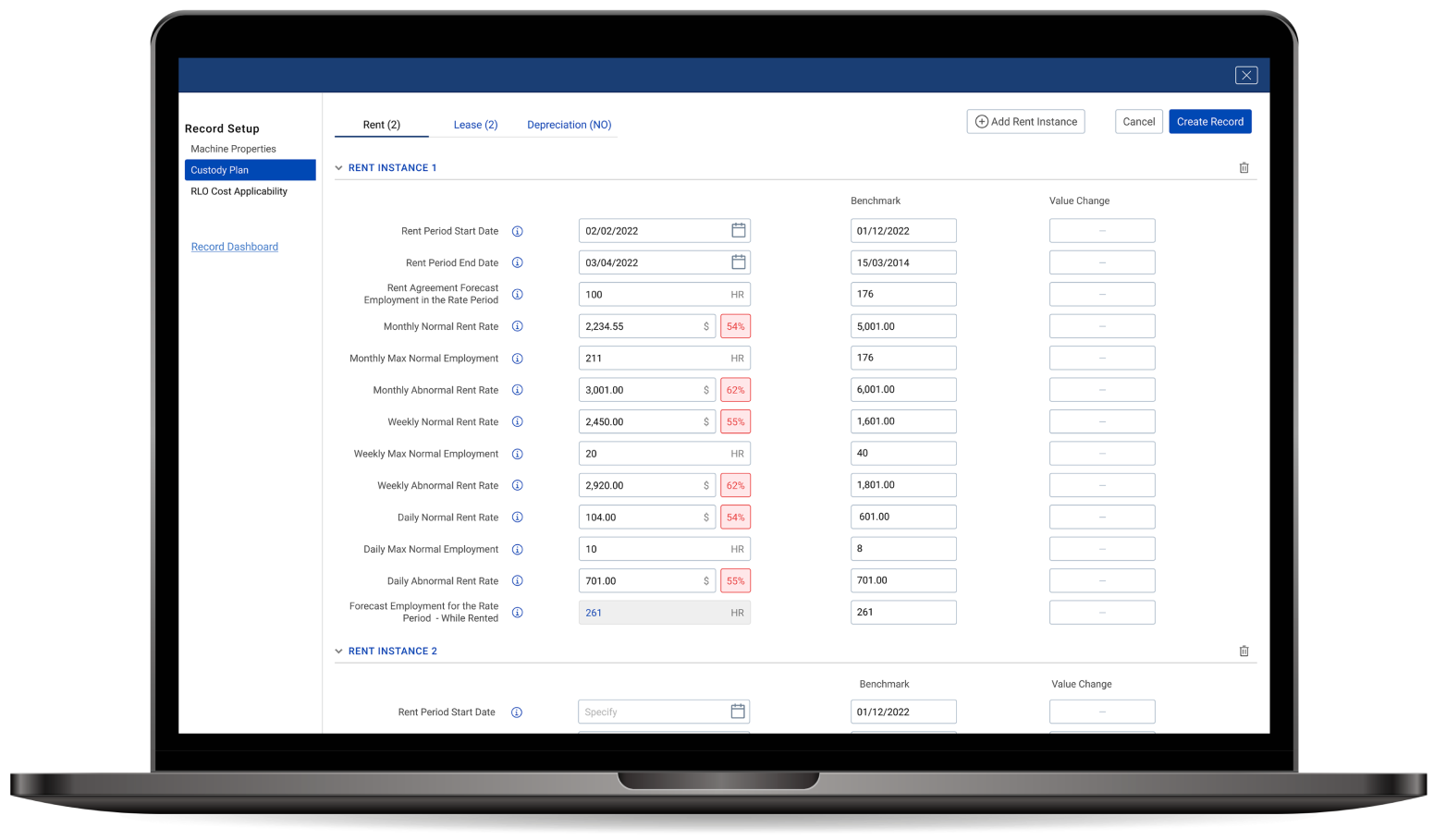

Check IoT projects we have successfully launched

IoT application with sensors for industrial fridge monitoring

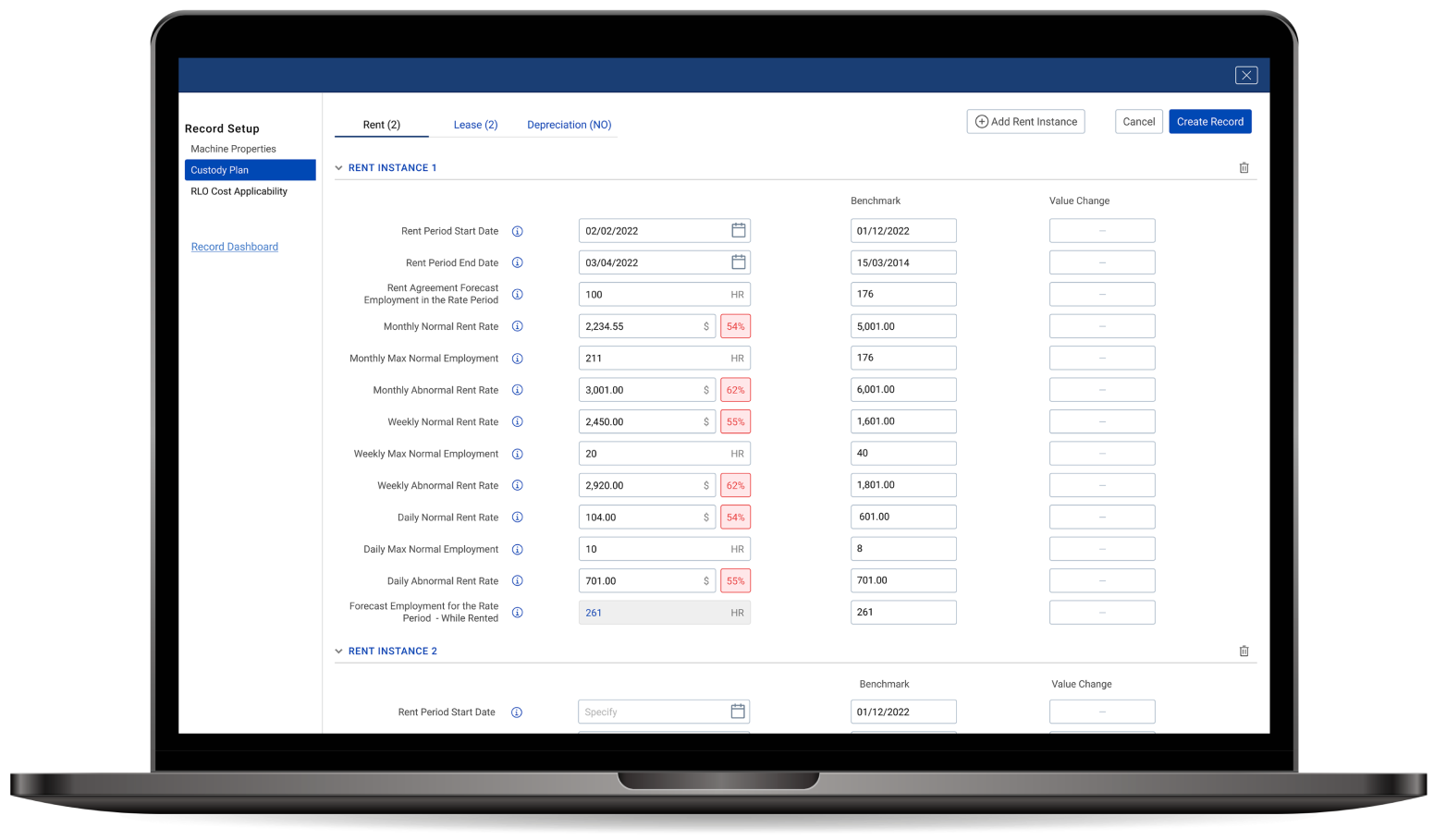

Cost management platform development

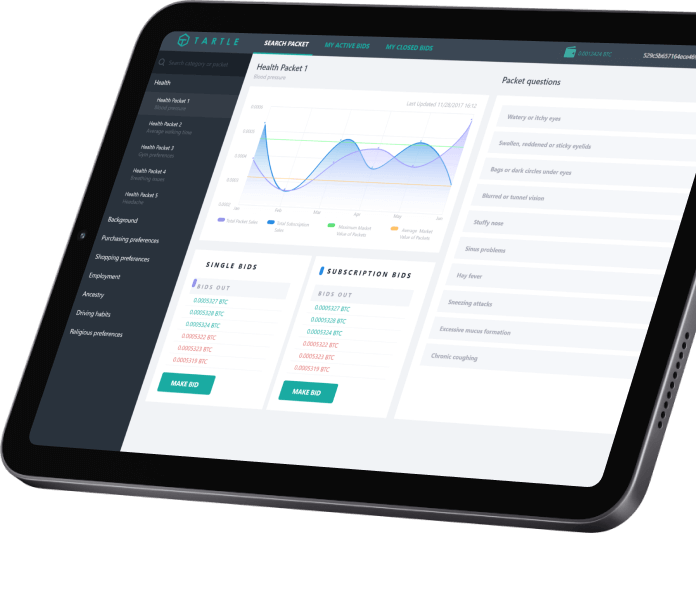

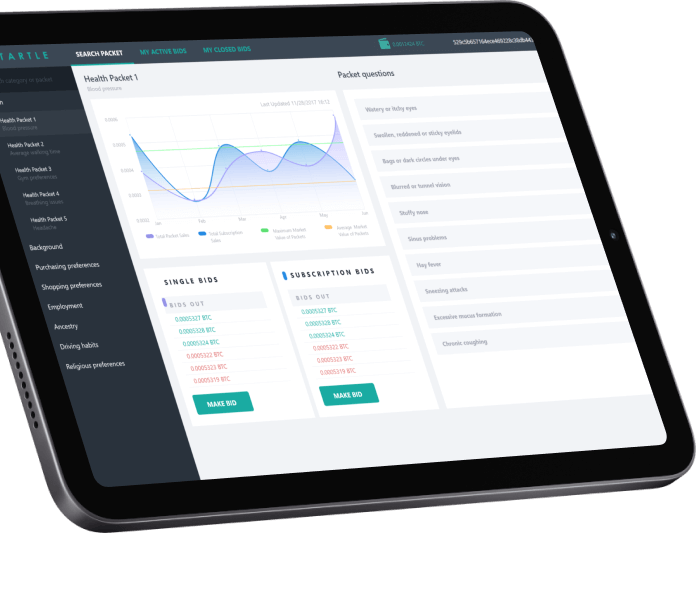

Innovative big data trading platform

Why choose SumatoSoft?

Our Rewards & Recognitions

Your IoT project starts here.

We’re ready to sign NDA

RFP analysis is absolutely free

We will respond to you within 24 hours